coinbase pro taxes uk

The UK taxman has scored a success in its ongoing attempts to obtain details about UK holders of crypto. The starting Coinbase Pro withdrawal limit is 50000 per day.

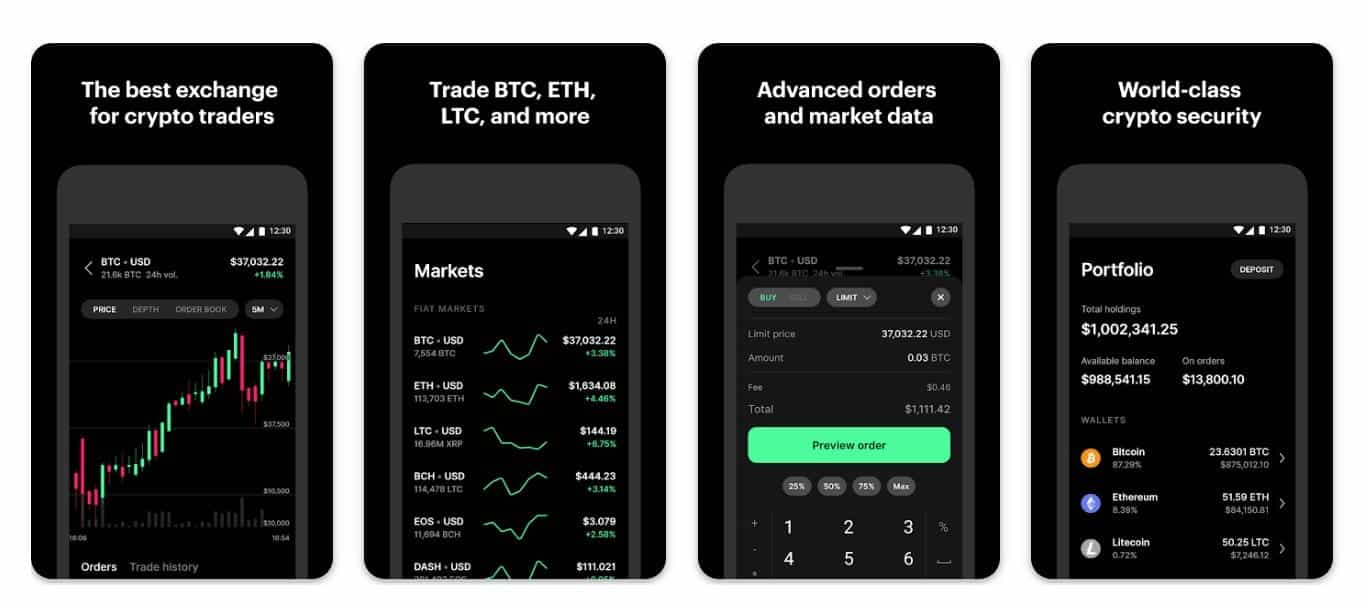

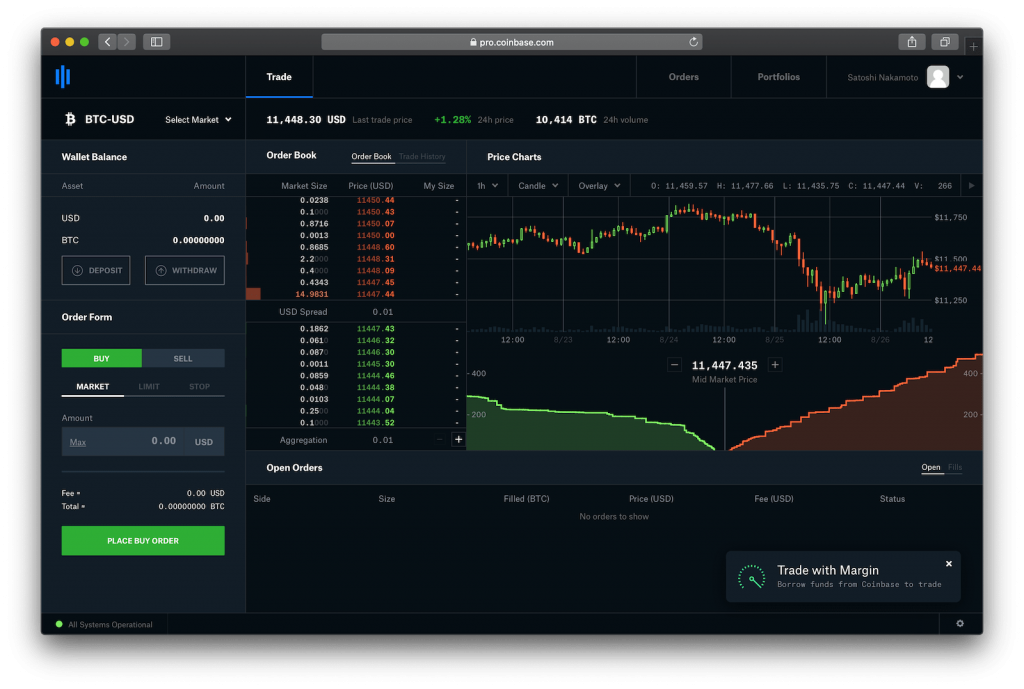

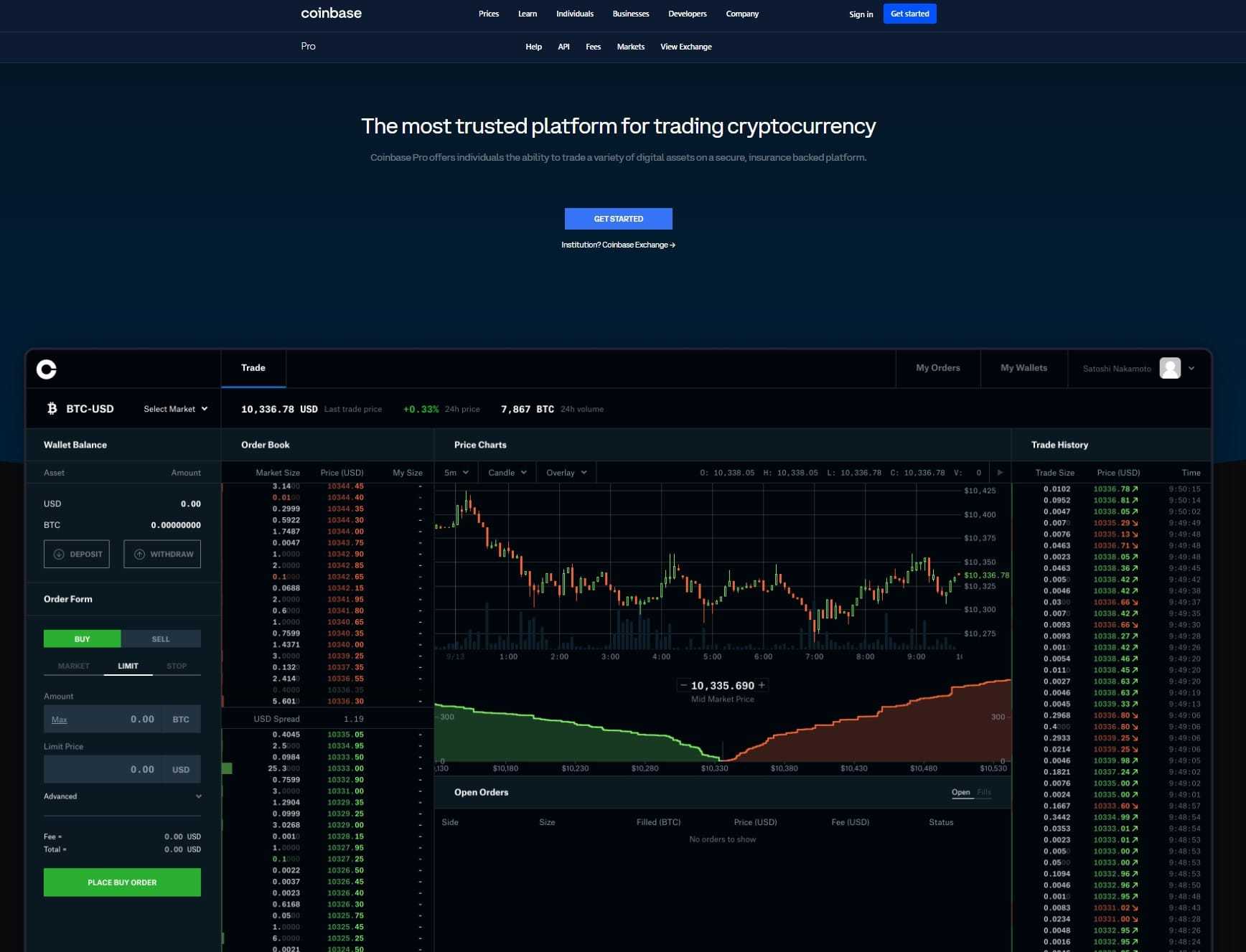

Coinbase Pro Review 2022 A Reputable And Safe Crypto Exchange

Users of the Coinbase exchange to own more than 5000 in cryptocurrency in the UK are going to have the details sent over to the HMRC.

. On Coinbase Pro. United Kingdom Buy sell and convert cryptocurrency on Coinbase. If another customer places an order that matches yours you are considered the maker and will pay a fee between 000 and 040.

Users may only earn once per quiz. I havent cashed out for a couple of years but saw they had finally integrated this function to be. Select New API Key.

In the top right corner select your profile. Main platform features. If you mined crypto youll likely owe taxes on your earnings based on the fair market value often the price of the mined coins at the time they were received.

If you are a Coinbase Pro customer and you meet their thresholds of more than 200 transactions and 20000 in gross proceeds then you will receive the IRS Form 1099-K. Coinbase does not provide a Form 1099-B like a traditional broker and as of the tax year 2020 will not be providing a Form 1099-KIt does provide a Form 1099-MISC on the. I started investing in stocks and crypto in the 202021 tax year so Ive never.

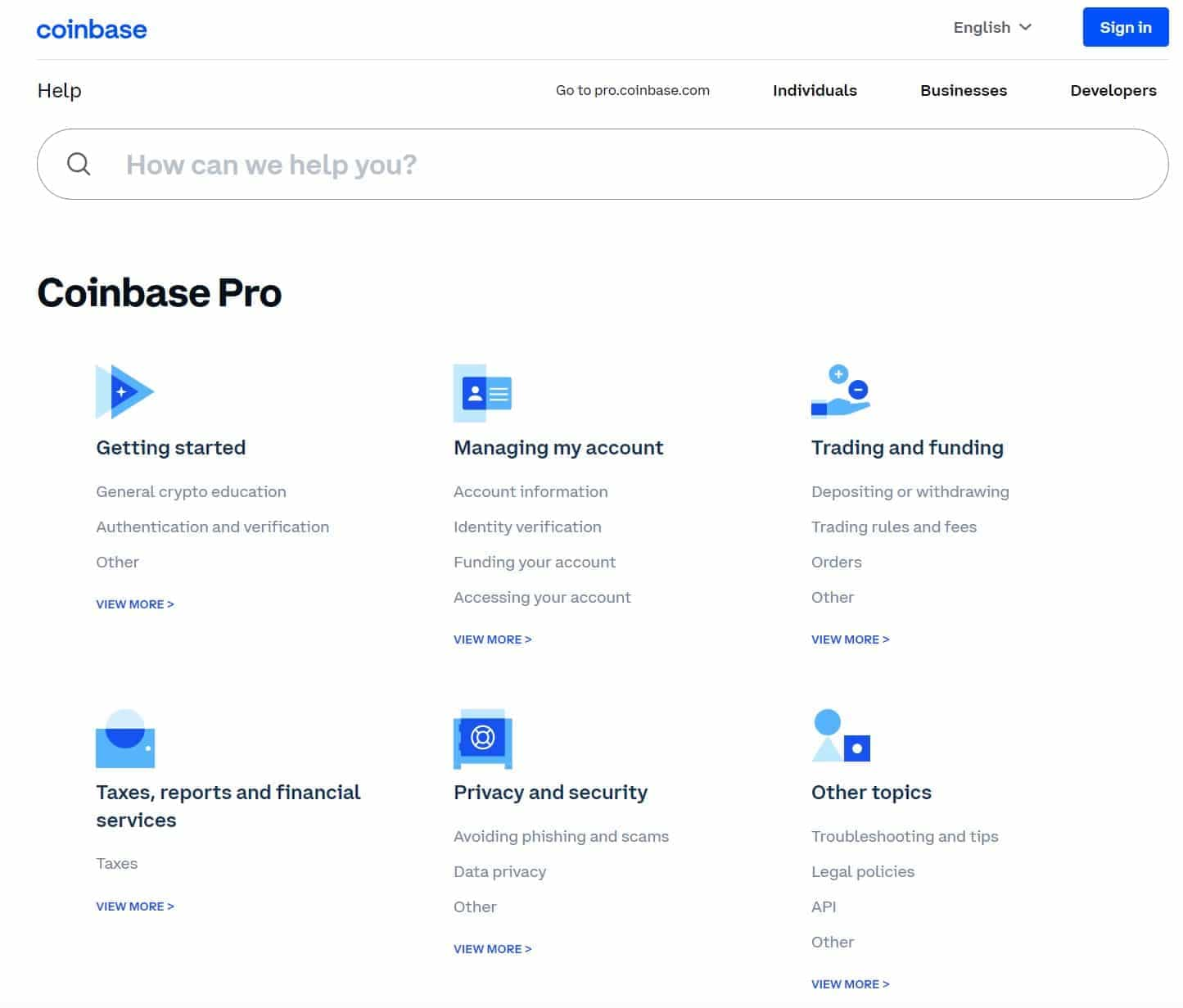

Easy to use for beginners and can use PayPal to withdraw or sell Fees. Within CoinLedger click the Add Account button on the top left. Ad Spend Your Time Trading Not Wondering What it Costs.

0 to 050 per trade 249 for Coinbase card transactions and the fee varies for. Log in to your Coinbase Pro account. Just executed the a first Coinbase Pro GBP direct withdrawal to UK bank account.

Its due at the end of the month. Coinbase reserves the right to cancel the learning rewards offer at any time. Easy safe and secure Join 103 million customers.

From the drop down menu select API. Coinbase is the most trusted place for crypto in United Kingdom. When you place an order that gets partially matched.

Coinbase UK Disclose Cryptocurrency Owners to HMRC. The interesting thing about this is that. Use the Coinbase tax report API with crypto tax software.

Find Coinbase Pro in the list of supported exchanges and select the import method you prefer. Must verify ID to be eligible and complete quiz to earn. If you use the Coinbase tax reporting API with a crypto tax app - all your Coinbase transaction history will be.

Im in the UK and Ive stupidly left my 202021 tax return until the last-minute. Interestingly this limit applies to an equivalent amount in all currenciesboth fiat and crypto.

Coinbase Pro Review 2022 A Reputable And Safe Crypto Exchange

Coinbase 1099 What To Do With Your Coinbase Tax Documents Lexology

Coinbase Pro Review 2022 A Reputable And Safe Crypto Exchange

The Ultimate Coinbase Pro Taxes Guide Koinly

The Ultimate Coinbase Pro Taxes Guide Koinly

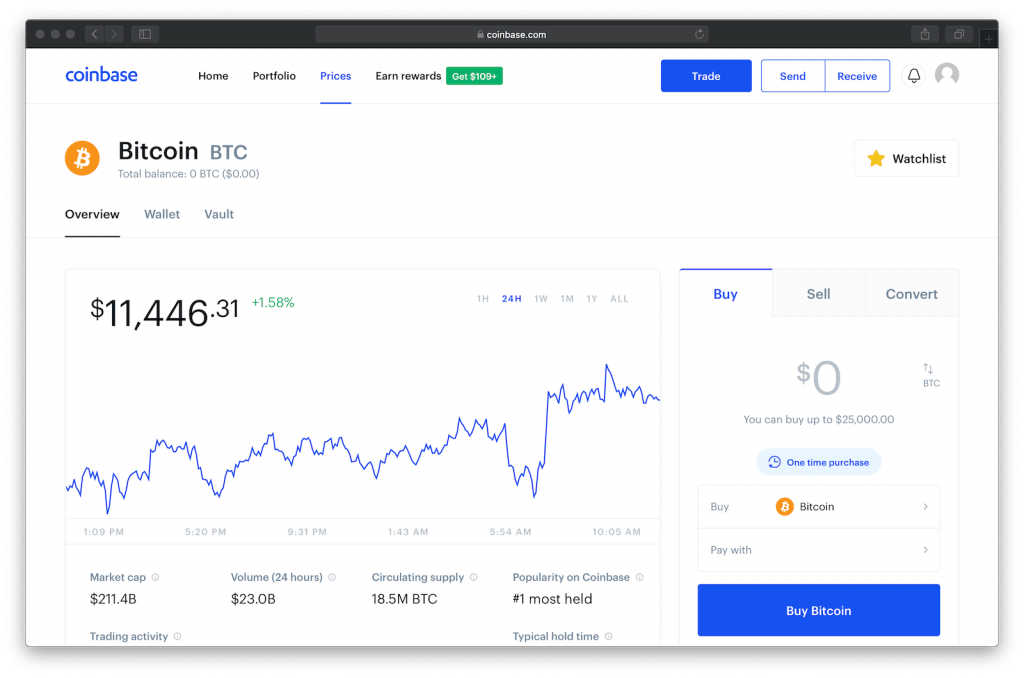

Coinbase Vs Coinbase Pro What The Difference Crypto Pro

Friendly Reminder On How To Reduce Coinbase Fees R Cryptocurrency

Coinbase Vs Coinbase Pro What The Difference Crypto Pro

:max_bytes(150000):strip_icc()/Uphold-vs-Coinbase-01-852cc0c408fa48399d4f3dd648f202c4.jpg)

Uphold Vs Coinbase Which Should You Choose

The Ultimate Coinbase Pro Taxes Guide Koinly

Coinbase Resources For 2019 Tax Returns By Coinbase The Coinbase Blog

Coinbase Pro Review 2022 A Reputable And Safe Crypto Exchange

Coinbase Pro Review 2022 A Reputable And Safe Crypto Exchange

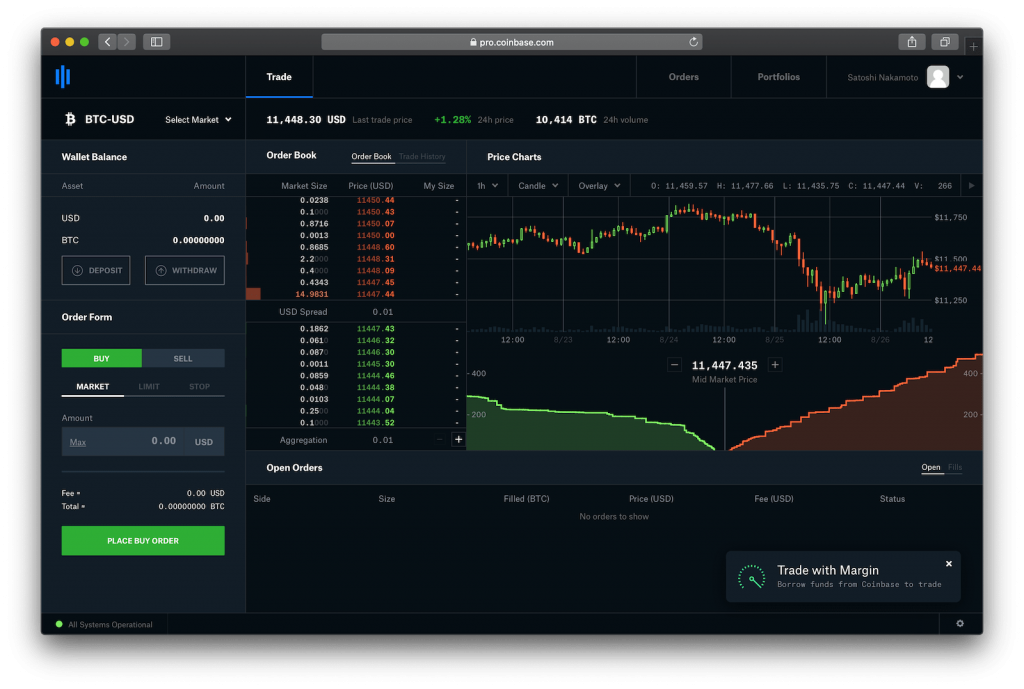

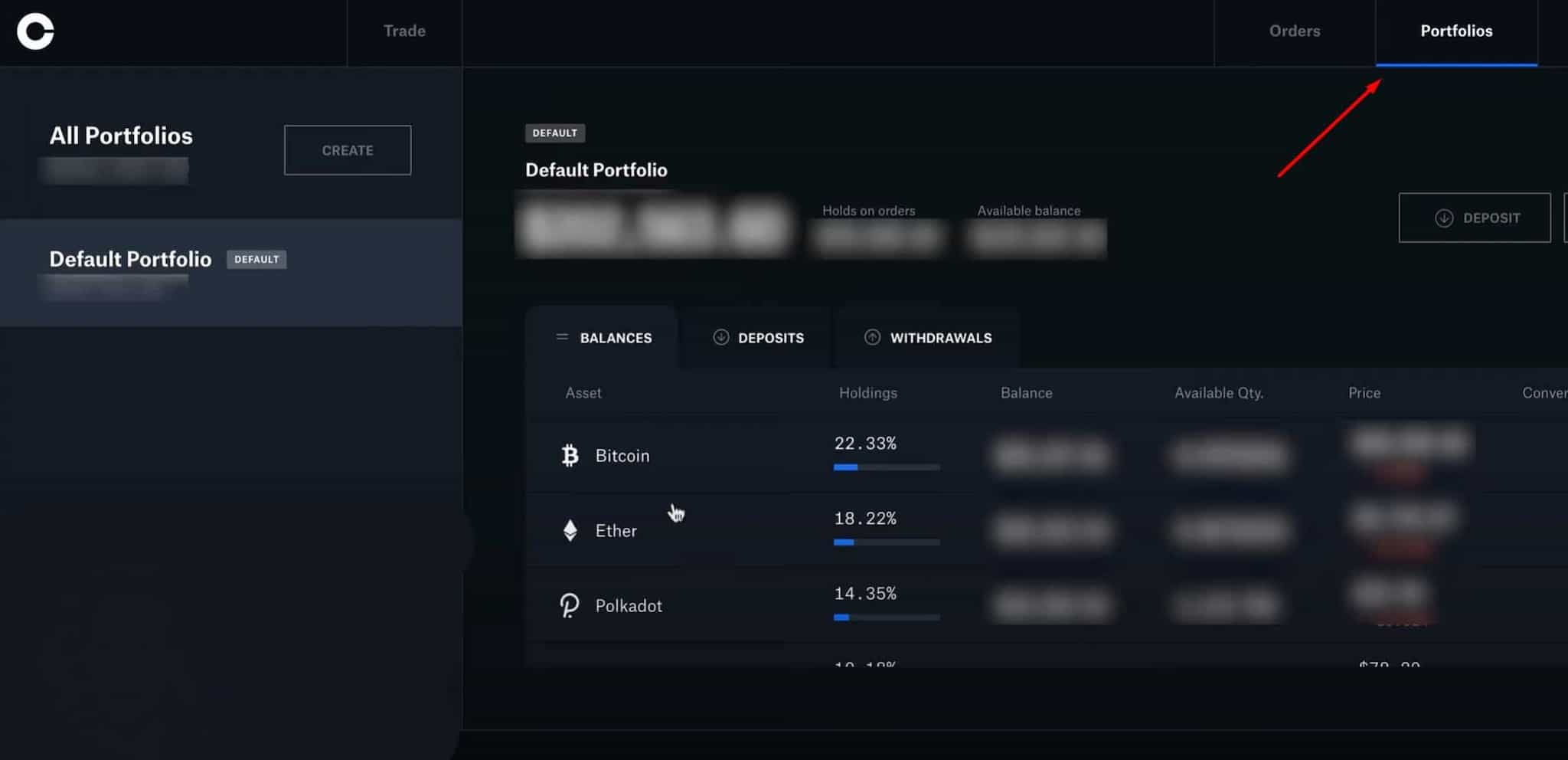

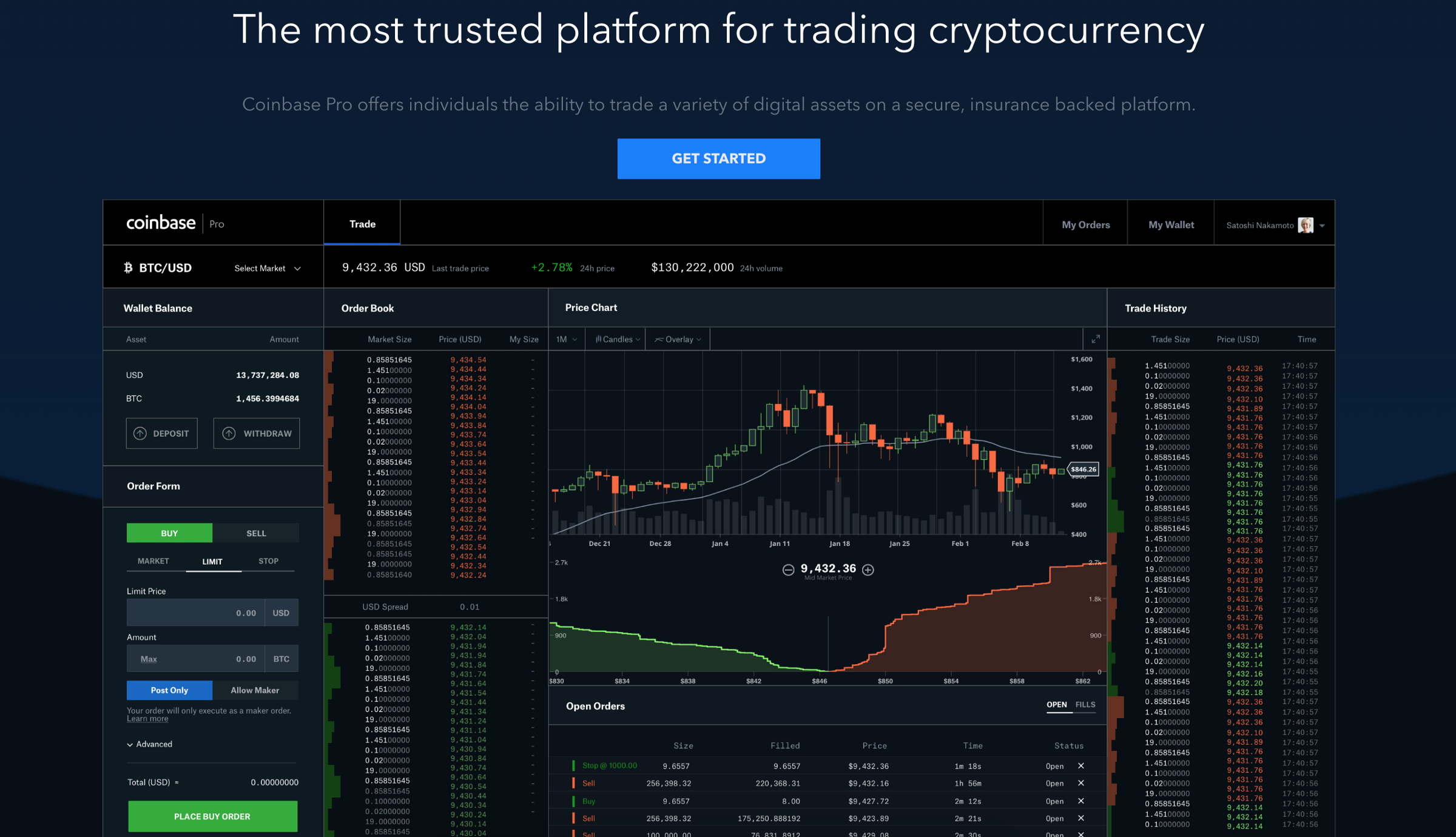

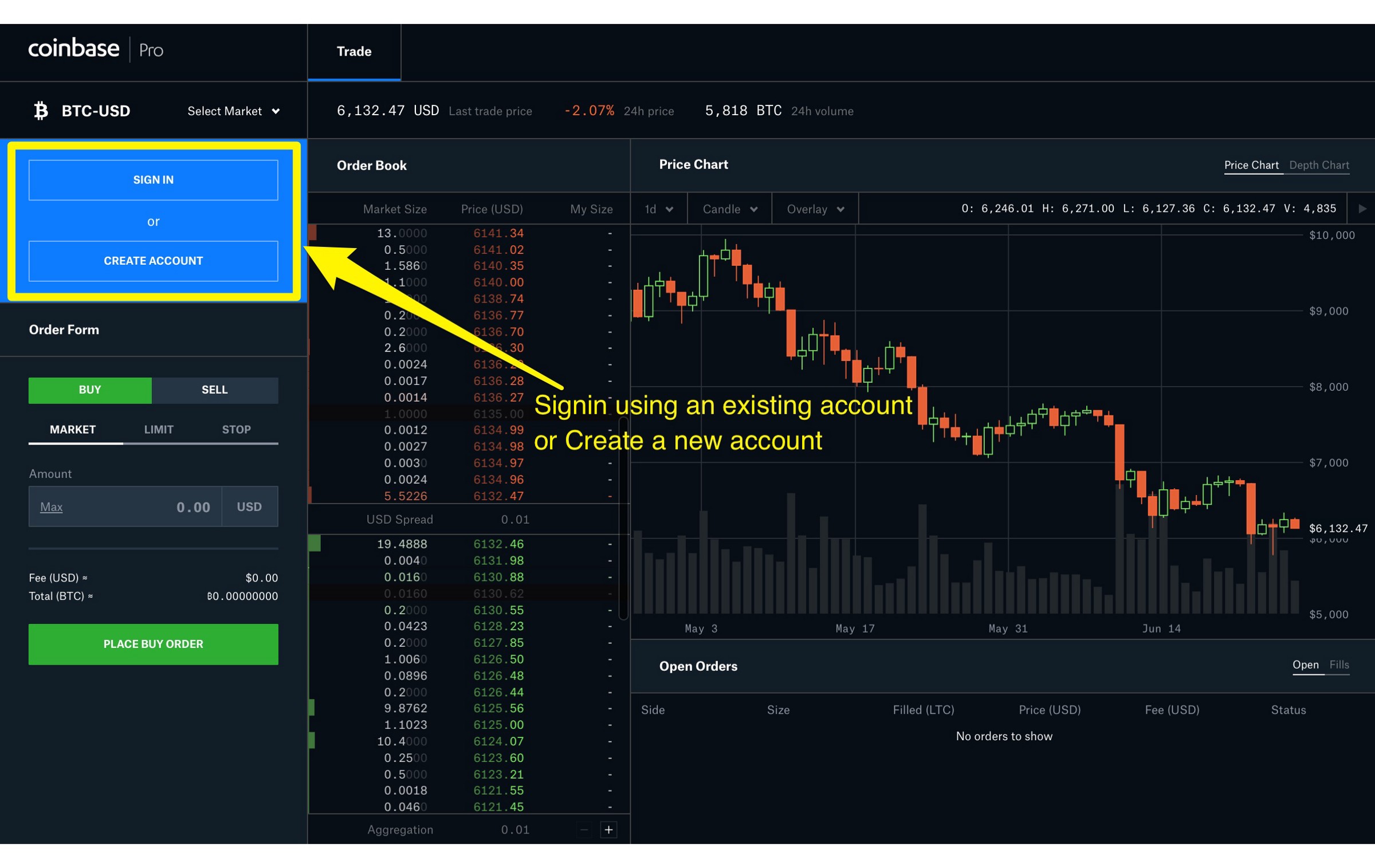

Beginners Guide To Coinbase Pro Coinbase S Advanced Exchange To Trade Btc Eth Ltc Zrx Bat Bch Hackernoon

Margin Trading Is Now Available On Coinbase Pro By Coinbase The Coinbase Blog

Coinbase Pro Review 2022 A Reputable And Safe Crypto Exchange

Beginners Guide To Coinbase Pro Coinbase S Advanced Exchange To Trade Btc Eth Ltc Zrx Bat Bch Hackernoon