georgia film tax credit 2020

An audit is required prior to utilization or transfer of any earned Georgia film tax credit that exceeds 25 million in 2021 125 million in 2022 and for any credit amount thereafter. Tax Credits Tax Credits Tax Credit Summaries.

The New Year S Resolution You Should Make And Keep Keep It Glam How To Stop Procrastinating Goal Setting Vision Board Learn A New Language

There are three main benefits for purchasing Georgia Entertainment Credits.

. An additional 10 percent uplift can be earned by including an embedded animated or static Georgia promotional logo provided by the Georgia Film Office. Register for a Withholding Film Tax Account. Income Tax Credit Policy Bulletins.

13 2020 at the state capitol in. The-board flat tax credit of 20 percent to certified projects based on a minimum investment of 500000 over a single tax year on qualified expenditures in Georgia. Jan 9 2020.

The 30 percent tax. Even amid the pandemic the state reported that 234 movies and tv shows filmed there during the 2020 fiscal year. August 5 2020 443pm.

Even amid the pandemic the state reported that 234 movies and TV shows filmed there during the 2020 fiscal year. August 5 2020 443pm. Big Changes Ahead for Georgia Entertainment Tax Credit By Staff on December 14 2020 News Georgias popular Film Tax Credit will undergo significant changes as of January 1 2021.

These audits can be conducted by third-party CPAs who meet certain criteria the bill says. A report from a state of Georgia auditor released Thursday calls into question the value of the states widely praised film tax credit program which has made Georgia an international. Instructions for Production Companies.

How-To Directions for Film Tax Credit Withholding. The new law appears to be in response to an audit report issued by the Department of Audits and. Paying less on Georgia income tax.

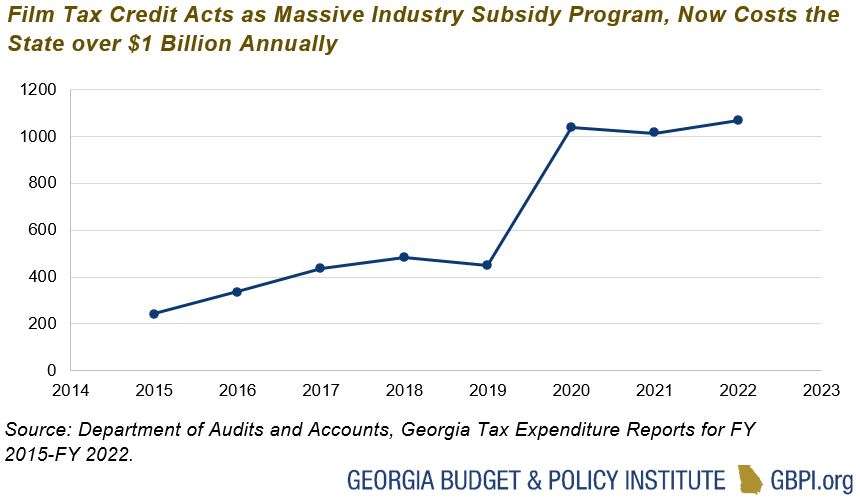

The Georgia film tax credit has worked as intended and built an industry that spends nearly 3 billion per year in the state and employs tens of thousands of Georgians in high-paying jobs the Georgia Screen Entertainment Coalition said today in response to the state of Georgias audit. Claim Withholding reported on the G2-FP and the G2-FL. Georgia doled out a record 12 billion in film and TV tax credits last year far surpassing the incentives offered by any.

Brian Kemp signed House Bill 1037 which requires mandatory audits of film tax credits. Unused credits carryover for five years. On average 1 of Georgia Film Tax credit can be purchased for 087 to 090.

The Georgia Department of Revenue GDOR offers a voluntary program. Qualified Education Expense Tax Credit. How to File a Withholding Film Tax Return.

A Georgia taxpayer may purchase Georgia Entertainment Credits generally for around 88 per credit and apply them to their current year or future tax returns. State Senate Finance Committee Chairman Chuck Hufstetler R-Rome speaks to reporters on Jan. To alleviate escalating concerns about the viability of the Georgia film tax credit Governor Kemp on August 4 2020 signed into law HB.

20 base transferable tax credit. 1037 which enacts significant procedural changes to the states film tax credit allowed pursuant to OCGA. On August 4 2020 Governor Kemp signed into law HB.

FAQ for General Business Credits. To alleviate escalating concerns about the viability of the Georgia film tax credit Governor Kemp on August 4 2020 signed into law HB. Third Party Bulk Filers add Access to a Withholding Film Tax Account.

The Georgia film tax credit long one of the worlds most generous subsidies for the entertainment industry. Important Changes to the Georgia Film Tax Credit. An amendment to a Georgia law will streamline the process of applying film and television tax credits in the state as officials said current rules have.

Maintenance on Georgia Tax Center and Alcohol Licensing Portal will occur Sunday May 15 from 9 am to 7 pm. The film tax credit is a good deal for Georgia and its taxpayers said Kelsey. How-To Directions for Film Tax Credit Withholding.

13 2020 at the state capitol in. Updated August 5 2020 Last week Gov. Getting a state tax deduction on Schedule A of your Form 1040 for the.

The bill removes the right of recapture by the state of any tax credits that undertake the new audit process and clarifies many related rules. Statutorily Required Credit Report. In output and 23816 jobs.

Georgia is a production-friendly state with transferable film tax credits up to 30 of qualified expenditures. On August 4 2020 Georgia Governor Brian Kemp signed House Bill 1037 HB 1037 which outlines several changes including a new application process mandatory audits timing of credit issuance and eligibility modifications. Brian Kemp approved changes to the Georgia Entertainment Industry Investment Incentive Act which requires mandatory audits by production companies before applying for the 30 film tax credit.

Georgia film tax credit draws scrutiny at budget hearing. Georgia Film Tax Credits were created to entice production companies to. The amendment to the Georgia law will reportedly streamline the process of applying for film and television tax credits in the.

Income Tax Credit Utilization Reports. Jeff Glickman JD LLM Partner-in-Charge of State and Local Tax Services at Aprio LLP. 4 2020 Georgia Gov.

The broadening of this legislation permits a Georgia corporate fiduciary or individual taxpayer to purchase these credits to offset their Georgia income tax liability. Income Tax Letter Rulings. 1037 which enacts significant procedural changes to the states film tax credit allowed.

The Georgia film tax credit program has generated more than 4 billion of tax credits since the programs inception. The bill removes the right of recapture by the state of any tax credits that undertake the new audit process and clarifies many related rules.

Georgia S Film And Tv Tax Credit Hits Record 1 2 Billion In Reimbursements

Essential Guide Georgia Film Tax Credits Wrapbook

Premium General 9 A Stack Of Great Art To Read Throw In Some Issues Of The New Yorker For When I Get Sick Of Scr Screenplay Save The Tiger Research Projects

Essential Guide Georgia Film Tax Credits Wrapbook

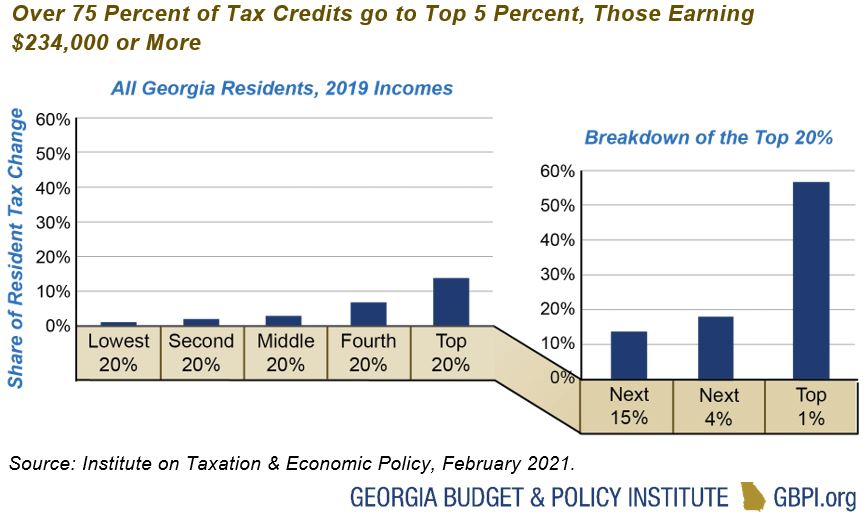

Georgia Tax Breaks Don T Deliver Georgia Budget And Policy Institute

Essential Guide Georgia Film Tax Credits Wrapbook

Georgia S Film And Tv Tax Credit Hits Record 1 2 Billion In Reimbursements

Essential Guide Georgia Film Tax Credits Wrapbook

Guest Essay Five Reasons Why Georgia Should Yell Cut On Film Tax Credit Arts Atl

2021 Cartier Roadster Ballpoint Pen Green Wholesale Cartier Roadster Ballpoint Pens Ballpoint

Georgia Tax Breaks Don T Deliver Georgia Budget And Policy Institute

Essential Guide Georgia Film Tax Credits Wrapbook

Sugar Creek Capital Film Entertainment Tax Credits

Film Incentives And Applications Georgia Department Of Economic Development

Subscribe To My Youtube Channel Link In Bio Graffiti Graffitis Graffitiart Graffiti Magazine Graffititi Street Art Street Art Graffiti Graffiti Wallpaper

Geographical Map Of Massachusetts And Massachusetts Geographical Maps Massachusetts Map Tax Credits